ERROL PARKER | Editor-at-large | Contact

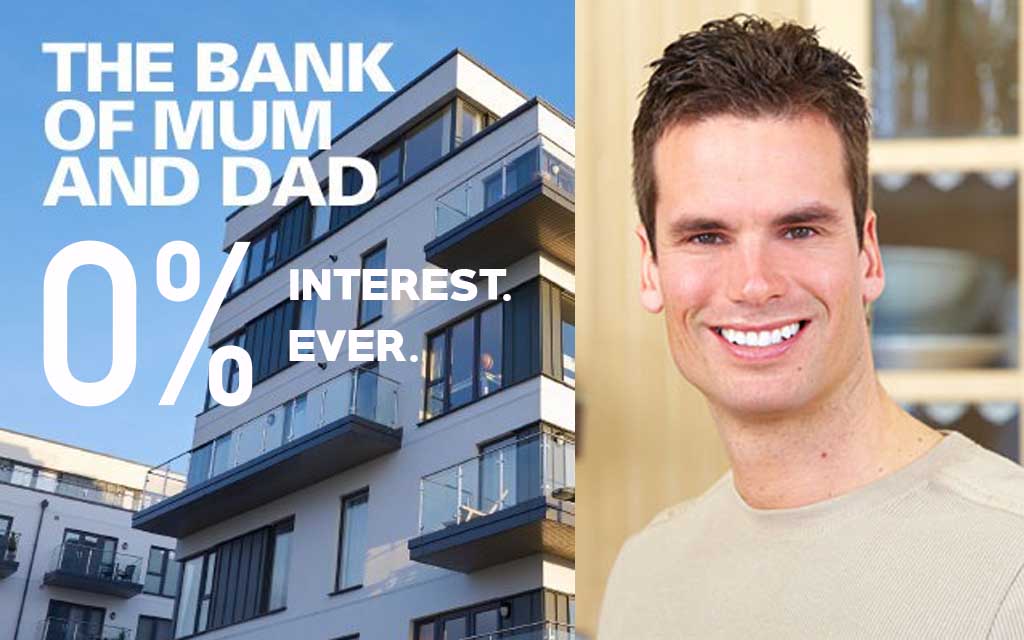

As mortgage stress and tumbling property prices begin to increase for millions of Australian families, one local homeowner has breathed a sigh of relief as his lender today announced they would not be passing on the interest rate hike.

The Bank Of Mum And Dad (BMD), a popular lender among our town’s well-heeled upper-middle-class, announced that their rates wouldn’t be raised any higher than their current 0%.

Speaking to The Advocate a few moments ago, local two-bedroom apartment owner Alistair Walton-Cartwright said that he was ‘stressed’ and ‘nervous’ about the recent increase in interest rates but ‘can now sleep’ knowing his repayments will remain the same for the foreseeable future.

“I’ve got a good relationship with my bank,” he said.

“When I was looking to buy, the big four and a few smaller lenders were full of hidden costs like stamp duty and establishment fees. But when some politician said to try BMD, I was shocked to learn that it was much cheaper,”

“They even put my repayments on hold if I go to Europe for summer or if I accidentally spend all my pay packet one month. Dad kind of yells at me a bit but Mum always comes into bat for me and scolds him back! But when they said my repayments might be going up, I shat my chinos. Then Dad said not to worry so I didn’t! [laughs]”

The Advocate reached out to The Bank Of Mum And Dad for comment but have yet to receive a reply.

More to come.